Month after month, there is an increasing interest in cryptocurrencies. People often hear about how crypto is supposed to change the world, make you rich or make you poor, and everything else in between. There is this constant duality where we are too afraid of missing out, but also too scared of getting in. My experience with cryptocurrencies has been nothing short of a constant emotional roller coaster, and I absolutely love it.

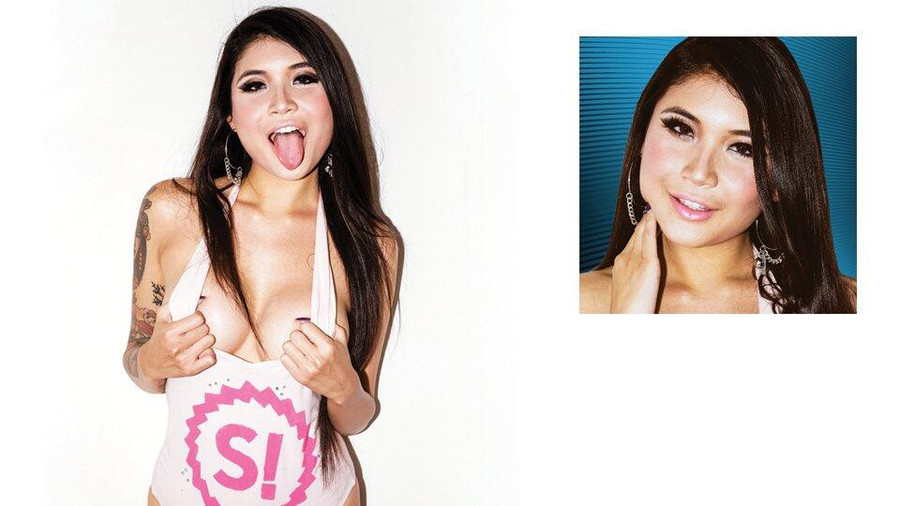

I’ve gone from nothing to something, from a career in filming porn to an advisor for SpankChain, a multimillion-dollar company focused on applying blockchain technology to the adult industry. When I’m not having fun at the SpankChain offices, my role as an advisor is to continuously analyze the adult industry and the blockchain industry. I use my insight to provide solutions that will solve problems, discover any new opportunities and prevent potential problems, ultimately contributing the necessary components that will allow our company to grow at a faster rate and remain ahead of the competition.

Crypto has gone from an underground technology that catered only to cyberpunks, to a technology that is threatening to overthrow or flip the largest industries onto their heads, including adult.

I got into cryptocurrencies in the early days, but not as an investor. When I began using cryptocurrencies, I was doing just that, using cryptocurrency — Bitcoin to be exact. It was money on the internet that was used to buy goods on the internet. The amount of Bitcoin I spent during those days has amounted to millions of dollars by today’s going rate, but I have no regrets.

A lot has changed since I first started. I’ve watched many cryptocurrencies fail and nothing but a few survivors make it back home, becoming the industry leaders of today. Back then, it was all about who was going be “the money of the future,” but today it’s all about figuring out how the technology behind cryptocurrencies can revolutionize every industry on the planet. Crypto has gone from an underground technology that catered only to cyberpunks, to a technology that is threatening to overthrow or flip the largest industries onto their heads, including adult.

When it comes to using cryptocurrencies for the first time, it feels daunting. Not only do you need to change the way you think about money, but you also have a bunch of people and media sites pitching you too many “revolutionary” coins to keep track of. The actual use of cryptocurrencies is actually quite easy though. We are so used to carrying a credit card and cash on us that when we try to do it on the internet, we get a bit of a brain fart. And when you step into the world of cryptocurrencies, you get this sudden realization of, “Wait a minute … where is the money held? How do I move it?” I’d like to clear that up for new users.

Cryptocurrency Consists of Four Parts:

1) Currency

I won’t go into too much depth here, since the topic of currencies could be an entire article on its own, but people usually start with Bitcoin or Ethereum. The reason people start with Bitcoin or Ethereum is that they’re the most established cryptocurrencies, have the most liquidity and can be traded for just about any other cryptocurrency if needed. Approximately nine out of 10 cryptocurrencies are powered by Ethereum, whereas Bitcoin makes up nearly 50 percent of the cryptocurrency market. Make no mistake, these two are clearly the King and Queen of cryptocurrencies.

2) Wallet

Wallets are like unique bank account numbers, and you can freely make as many as you wish. Each wallet comes with a unique “wallet address” assigned to it that can’t be changed. Once you’ve traded for cryptocurrency, it’s going to be stored in a wallet. No matter where you get your cryptocurrency, it will be sitting in a wallet. The only time your money is not inside of a wallet is when it is being transferred to another wallet. Wallets come in many forms, often sacrificing levels of security for convenience. The general rule of thumb is, put your savings into a high-security wallet and put your spending money into a more convenient wallet like an app on your phone.

Look at it this way … if you want your money to be secure, you could keep it in a vault, but that wouldn’t really be convenient, would it? Imagine every time you went to McDonald’s or used a gas station, needing to visit a vault first. If you plan to use the money often, then keeping your money in a vault would be a huge pain and you’d much rather opt-in for maybe a nice leather wallet or purse. Why do we do this? For convenience. The key idea here is security versus convenience. We don’t always need maximum security, nor do we always need convenience. We only need a balance that matches our lifestyle. Just like you wouldn’t want to walk around with your life’s savings in your pocket, you wouldn’t want to keep all your money in a vault either.

Unlike traditional wallets, cryptocurrency wallets are incredibly secure, even the convenient ones. You have a better chance of breaking into a bank vault than breaking into a basic cryptocurrency wallet.

3) Transfers

The point of money, ultimately, is to exchange it with other people, institutions and companies for goods, services or moneymaking opportunities. It would be silly if money just sat in one place and never went anywhere, because then it wouldn’t even really be money anymore! Money wants to be free, and it wants to move and serve a purpose. All wallets have a built-in feature to let you move money. It’s usually labeled as “withdraw” and “deposit.” This is just like a bank, where if you need to take money out, you can withdraw. If you need to put money into your account, you make a deposit.

4) Security

This is probably the most difficult change to adjust to when using cryptocurrencies. We’ve grown so accustomed to handing our money to strangers, like banks, to hold onto it and protect it. Humans have gotten used to giving up their right to their own money in exchange for security. Sounds a bit contradicting, if you ask me. Fast-forward a few centuries and we are now required to secure our own money in exchange for power over our money. As the old saying goes, “With great power comes great responsibility.” Should we continue this path of giving up our power in exchange for being lazy and irresponsible? I don’t think so. Learning some basic security is all that is needed, which is a small price to pay for something so valuable.

These are just some simple elements that hopefully have introduced you to the world of cryptocurrencies with better insight. If you’d like a more detailed look at cryptocurrencies, you can visit my Twitter at @brennasparksxxx where I post links to my topless cryptocurrency video series. In the series, I give step-by-step instructions, while providing you with some eye candy, as well!

Brenna Sparks is a Laotian adult star and cam model whose advocacy for SpankChain as a company advisor stems from her dedicated investment in cryptocurrency and blockchain technology. Follow her on Twitter @brennasparksxxx and on Instagram @brennasparksofficial for updates about her latest endeavors.